WE NEED YOU.

The majority of Sunnybrook's ministry is dependent upon gifts from individuals and businesses like you. The more we partner with our community, the more we can reach Mississippi’s foster children, of which there are more than 4,000 as reported by the MS Department of Child Protection Services.

For 60 years, children have found hope and healing through Sunnybrook. We are committed to developing ways to reach a vulnerable population of hurting children and teenagers. If left unserved, foster youth will continue contributing to the overwhelming population of Mississippi’s homeless, jobless, and incarcerated individuals.

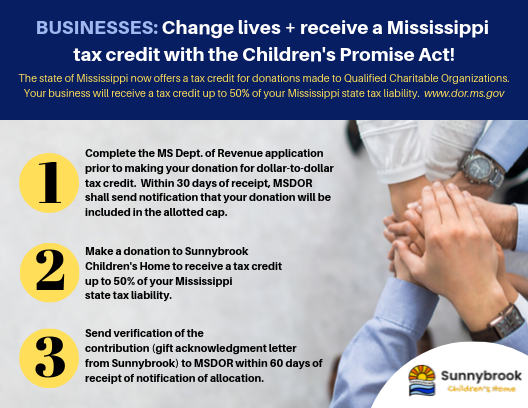

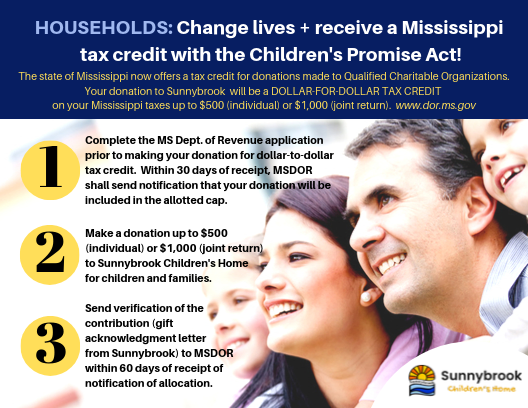

If you have any questions at all about this opportunity to partner with us while receiving tax credit, please give us a call at (601) 540-4253 or email Ron Veazey.